Ever heard of The Rule of 72?

credits to https://unsplash.com/@iridial_

The Rule of 72 is a straightforward formula that helps you estimate how long it will take for an investment to double in value based on its annual rate of return. It’s a handy mental math tool often used by investors, financial planners, and anyone curious about how their money can grow. Check out the article about budgeting here!

How Does the Rule of 72 Work?

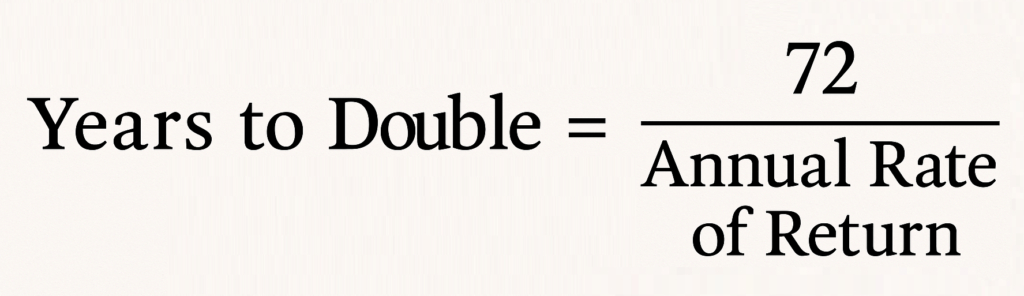

The formula is simple:

Here’s how it works:

- Take the number 72.

- Divide it by the annual interest rate (expressed as a whole number, not a decimal).

For example:

- If your investment earns an 8% annual return, divide 72 by 8:

- 72÷8=9 years

This means it will take approximately nine years for your investment to double.

When Is the Rule of 72 Useful?

The Rule of 72 is most accurate for investments with annual compound interest rates between 6% and 10%. It works well for:

- Investments: Estimating how long it will take for your savings or portfolio to grow.

- Inflation: Calculating how quickly inflation will halve your purchasing power.

- Debt: Understanding how quickly credit card debt can double if left unpaid.

Examples of the Rule in Action

- Investment Growth:

- Suppose you invest $10,000 at a 6% annual return. Using the Rule of 72:

- 72÷6=12 years

- Your investment will double to $20,000 in 12 years.

- Inflation Impact:

- If inflation is at 3%, divide 72 by 3:

- 72÷3=24 years

- In this scenario, the value of your money will halve, or the price of goods will double, in approximately 24 years.

- Credit Card Debt:

- For a credit card with a 24% interest rate, divide:

- 72÷24=3 years

- Your debt could double in just three years if unpaid. A $10,000 credit card debt will amount to $20,000 in just three years.

Why Does It Work?

The Rule of 72 is based on logarithmic mathematics and compound interest principles. While not perfectly precise, it provides a close estimate without requiring complex calculations. For lower interest rates, it’s highly accurate; for higher rates, slight deviations may occur.

Limitations

- Simple Interest: The rule only applies to compound interest, not simple interest.

- Extreme Rates: It becomes less accurate for very high or very low rates outside the typical range (6%-10%).

- Stability Assumption: It assumes a fixed annual rate of return, which might not reflect real-world fluctuations.

A Historical Perspective

The Rule of 72 has been around for centuries. It was first mentioned in a mathematics text from the late 1400s by Luca Pacioli and remains a popular financial tool today.

Final Thoughts

The Rule of 72 is an easy-to-use shortcut that simplifies financial planning. Whether you’re calculating investment growth, assessing inflation’s impact, or managing debt, this rule offers quick insights into how money grows (or shrinks) over time. It’s not perfect but it’s an invaluable tool for making informed financial decisions.

One thought on “The Rule of 72: Double Your Value!”