We all know debt. We have seen what it can do, both good and bad. Debt can be both a useful financial tool and a source of stress. Understanding the different types of debt, their risks, and how to manage them effectively is essential. In this article, we will understand debt further. Here’s a comprehensive overview of personal debt, focusing on why some people fear it, how much of your income should go toward repayment, and whether you should consider taking on debt.

If you’d like to understand more about your debt, you can visit our calculator here. You’ll gain insights into the total interest you’ve paid and see how making small extra payments each month can significantly reduce your debt.

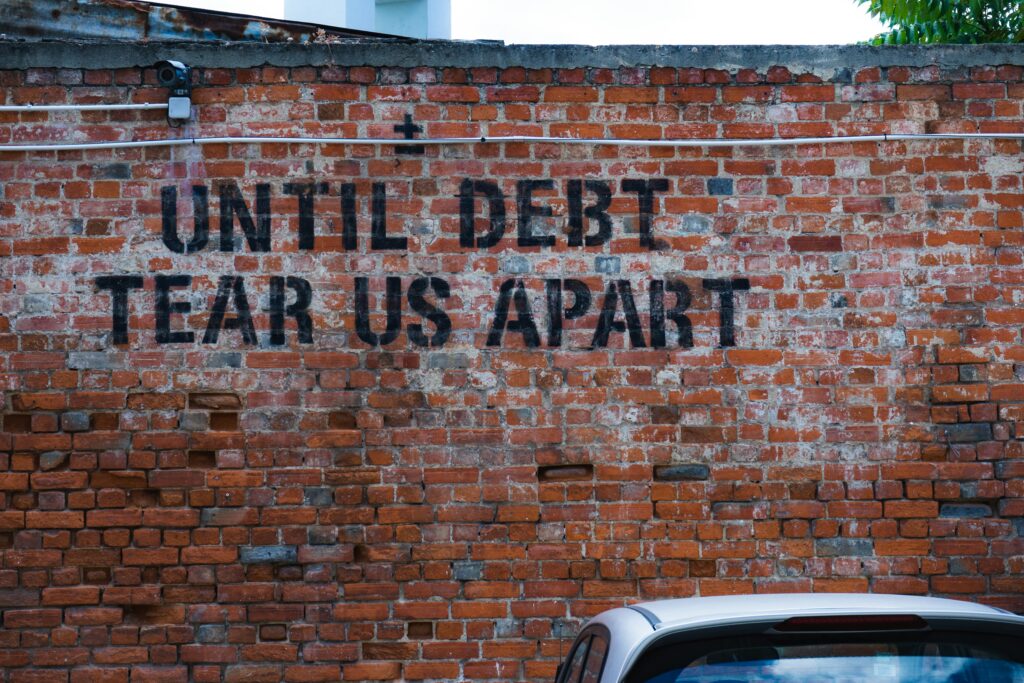

credits to https://unsplash.com/@towfiqu999999

Why People Fear Debt?

Debt can be a useful financial tool, but for many, it’s a source of anxiety and stress. While some people manage debt effectively, others fear it due to its potential risks and long-term consequences. You probably have witnessed or heard stories of people grappling with debt and its consequences. Here are some of the key reasons why people fear debt:

1. High Interest Rates and Growing Balances:

One of the most common reasons people fear debt is the high cost of borrowing. Interest rates on credit cards, payday loans, and other unsecured debts can quickly grow balances beyond what borrowers can afford to repay. For example:

credits to https://unsplash.com/@averye457

- Credit Card Debt: Interest rates often range between 15% and 30% APR.

- Payday Loans: These can have APRs exceeding 300%-1,000%, making repayment nearly impossible for many borrowers.

This compounding effect creates a cycle where borrowers struggle to make even minimum payments, leading to mounting debt.

2. Economic Instability

Broader economic conditions like inflation, rising interest rates, or recessions exacerbate financial stress for those in debt:

- A 2023 survey found that 70% of Americans felt stressed about money, with inflation being a primary concern. You find out more here.

- Rising interest rates make it more expensive to service existing debts like student loans or mortgages, adding to the financial burden.

Even individuals with stable incomes may worry about how economic downturns could affect their ability to repay debts. You may be able to afford it now, but when the interest rate rises, so will your repayments. Worse still, your job security may be at stake during an economic downturn.

3. Fear of Losing Control

Debt often creates a sense of helplessness:

- Decision Paralysis: The fear of making the wrong financial decision can prevent people from taking any action at all.

- Avoidance Behaviors: Many avoid looking at bank statements or discussing finances with loved ones, which can worsen their debt problems over time.

This lack of control over one’s financial situation can lead to feelings of despair and anxiety.

4. Mental Health Impacts

Debt is closely linked to mental health issues such as stress, anxiety, and depression:

- A study by the Royal College of Psychiatrists found that half of adults with debt problems also experience mental health challenges. Read the study here.

- Financial stress can disrupt sleep, lower self-esteem, and even lead to physical health problems like weight fluctuations or chronic fatigue.

These mental health struggles often create a vicious cycle where poor emotional well-being makes managing debt even harder.

5. Social Stigma

Debt carries a significant social stigma in many cultures. People may feel ashamed or embarrassed about their financial struggles:

- This stigma often prevents individuals from seeking help or discussing their debt openly with friends or family.

- Societal pressures equating wealth with success amplify this shame, making people feel inadequate if they cannot maintain a certain lifestyle

6. Unpredictable Life Events

Unexpected life events can push people into debt or worsen existing financial problems:

- Medical Bills: High healthcare costs are a leading cause of personal bankruptcy in many countries.

- Job Loss: Losing a job disrupts income and makes it difficult to keep up with bills.

- Divorce: Legal fees and splitting assets can leave both parties financially strained.

These events often force individuals to rely on credit cards or loans as temporary solutions, leading to long-term debt issues.

7. Harassment from Creditors

For those who fall behind on payments, persistent calls and letters from creditors can add another layer of stress:

- Harassment from collection agencies is not only emotionally draining but also impacts daily life by creating constant reminders of financial struggles.

credits to https://unsplash.com/@towfiqu999999

8. Lack of Financial Education

Many people fear debt simply because they don’t understand how it works:

- Without knowledge about budgeting, interest rates, or repayment strategies, individuals may feel overwhelmed by their financial obligations.

- This lack of understanding often leads to poor decisions like taking out high-interest loans without fully grasping the consequences.

9. Fear of Losing Assets

For secured debts like mortgages or car loans, missing payments can result in repossession or foreclosure:

- The possibility of losing one’s home or vehicle creates significant emotional and financial stress.

- This fear is particularly acute during economic downturns when job security is uncertain.

10. Long-Term Financial Impact

Debt can have lasting effects on one’s financial future:

- High levels of debt reduce disposable income, limiting opportunities for saving or investing.

- Poor credit scores resulting from unpaid debts make it harder to secure loans for major life goals like buying a home or starting a business.

This long-term impact makes many hesitant to take on any form of debt.

Why People Embrace Debt?

On the flip side, some people embrace debt. These are some of the key factors why people embrace debt.

1. Access to Opportunities

Debt allows individuals to pursue goals they couldn’t otherwise afford upfront. For example:

- Student Loans: Enable access to higher education, which can increase earning potential over a lifetime.

- Mortgages: Make homeownership achievable, leveraging property appreciation over time.

- Business Loans: Provide funding for entrepreneurs to start or grow their ventures.

credits to https://unsplash.com/@precondo

2. Improved Quality of Life

Many believe debt enhances their standard of living by financing essentials like homes or cars.

3. Financial Leverage

Debt can be used strategically to grow wealth:

- Real estate investors use mortgages to acquire rental properties that generate income.

- Businesses use loans to purchase inventory or equipment without sacrificing equity.

4. Building Credit

Responsible borrowing and timely repayment improve credit scores, enabling access to better financial products in the future.

5. Tax Benefits

Certain types of debt, like mortgages or business loans, offer tax-deductible interest payments, reducing the overall cost of borrowing.

6. Lifestyle Inflation

Some people use debt to fund lifestyles beyond their means—luxury goods, expensive vacations, or high-end gadgets—often leading to unnecessary accumulation of high-interest credit card debt.

7. Social Status and Acceptance

In a society that equates wealth with success, some people incur debt to maintain appearances or keep up with peers. Social media often exacerbates this by promoting unrealistic standards of living.

8. Emotional Spending

Debt can become an emotional outlet for coping with stress or dissatisfaction. For instance:

- BNPL services give the illusion of affordability by splitting payments over time and encouraging impulsive purchases.

- Studies show people are more willing to take on long-term loans with smaller monthly payments because they feel less “pain” in paying.

9. Lack of Financial Education

Many borrowers don’t fully understand the terms or long-term consequences of their debt. For example:

- Payday loans often carry APRs exceeding 300%-1,000%, trapping borrowers in cycles of repayment.

- BNPL platforms charge interest rates as high as 30% if payments are missed.

10. Addictive Behavior

Some individuals develop a reliance on debt as a quick fix for financial problems without addressing underlying issues like overspending or a lack of savings.

credits to https://unsplash.com/@paramir

What types of Debt are there?

Most people think of debt as just owing money to someone or an organization. However, debt can be classified into different categories. We have categorized debt into four main types:

1. Secured Debt

Secured debt is backed by collateral (e.g., mortgages or auto loans).

- Advantages: Lower interest rates due to reduced risk for lenders.

- Risks: If payments are missed, collateral like homes or cars can be seized.

2. Unsecured Debt

Unsecured debt relies on the borrower’s creditworthiness (e.g., credit cards and personal loans).

- Advantages: No collateral required.

- Risks: Higher interest rates compared to secured debt.

3. Revolving Debt

Revolving debt provides access to a reusable line of credit (e.g., credit cards or HELOCs).

- Advantages: Flexibility to borrow as needed.

- Risks: High interest rates if balances aren’t paid monthly.

4. Installment Debt

Installment debt involves fixed payments over time (e.g., mortgages or auto loans).

- Advantages: Predictable payments make budgeting easier.

- Risks: Missed payments can damage credit scores.

Licensed vs. Unlicensed Lenders

Debt can come from both licensed and unlicensed lenders:

- Licensed Lenders: Banks, credit unions, and reputable financial institutions offer regulated loans with clear terms.

- Unlicensed Lenders: Payday lenders or loan sharks charge exorbitant interest rates and often engage in predatory practices.

Unlicensed lenders should be avoided due to their lack of consumer protections. However, some people engage with unlicensed lenders because they are unable to secure loans from licensed lenders due to factors such as having a poor credit score.

How Much of Your Income Should Go Toward Debt Repayment?

Financial experts recommend that no more than 36% of your income should go toward debt repayment. This is known as the “debt-to-income ratio,” which ensures borrowers maintain financial stability while meeting obligations.

This guideline is widely accepted in many countries, including the U.S., Canada, and the U.K., as a benchmark for assessing personal financial health.

In countries such as Singapore, when applying for a loan, lenders will assess your ability to repay using the Total Debt Servicing Ratio (TDSR), which calculates the ratio of your gross income used to repay your monthly debt obligations. TDSR should not exceed 55% of gross monthly income.

Interest Rates on Different Types of Debt

Interest rates vary significantly across debt types:

- Credit Cards: Typically have high interest rates, often between 15% and 30% APR.

- Personal Loans: Rates can range from 6% to 36%, depending on creditworthiness.

- Mortgages: Generally offer lower rates, around 2% to 6% in many developed countries.

- Payday Loans: Can have APRs ranging from 300% to over 1,000% in some cases.

credits to https://unsplash.com/@jpvalery

Should You Go Into Debt?

Debt isn’t inherently bad—it depends on how it’s used:

- Good Debt: Includes mortgages or student loans that help build wealth or increase earning potential.

- Bad Debt: Includes high-interest consumer loans for non-essential purchases.

Before taking on debt:

- Assess your ability to repay within the recommended income threshold.

- Understand the terms and interest rates.

- Avoid borrowing for unnecessary expenses.

When considering whether to go into debt, it’s crucial to ask yourself some important questions.

- What are the long-term implications of this debt?

- Can you afford the monthly payments?

- Are there alternative ways to achieve your goals without borrowing?

- How will debt impact your financial stability and personal relationships?

credits to https://unsplash.com/@cdubo

Taking the time to reflect on these questions can help you make a well-informed decision.

For instance, consider the story of newlyweds who go into debt just to have a lavish wedding.

Yes, the wedding was AMAZING, and everyone talked about it for weeks.

However, imagine starting your life together burdened by financial obligations, rather than enjoying the freedom and peace of mind that comes with a debt-free beginning.

This real story highlights the importance of carefully weighing the pros and cons before deciding to take on debt. By doing so, you can ensure that your financial decisions align with your long-term goals and values.

Final Thoughts

Debt is a double-edged sword—it can be a stepping stone toward achieving financial goals or a trap that leads to financial distress. By understanding the types of debt, avoiding predatory lending practices, and keeping repayment within manageable limits, you can use debt as a tool rather than letting it control you.

Remember, informed decisions today will shape your financial future tomorrow!

What do you think about debt?

Do you have good debt, bad debt, or both?

Share your stories with us.

Explore our articles on zero-based budgeting and strategies to boost your income and unlock more opportunities.

One thought on “The Debt Equation: The Good, the Bad, and Beyond”