credits to https://unsplash.com/@giorgiotrovato

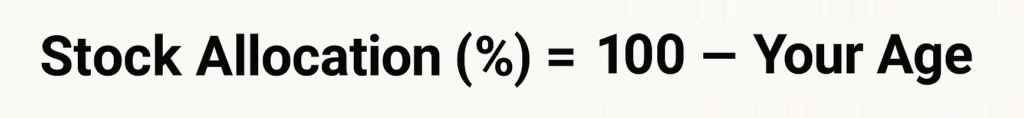

The Rule of 100 is a widely recognized guideline in retirement planning.

Aside from budgeting and investments, have you given some thought about your retirement? Let’s discover The Rule of 100. It provides a straightforward method for determining the optimal allocation of your investments between riskier assets, such as stocks, and safer options, including bonds and cash. This rule helps retirees balance growth and preservation as they age, ensuring their portfolio aligns with their risk tolerance and financial goals.

credits to https://unsplash.com/@harlimarten

What Is the Rule of 100?

The Rule of 100 works by subtracting your age from 100 to calculate the percentage of your portfolio that should be invested in stocks. The remainder is allocated to safer, more conservative investments like bonds or cash equivalents.

Formula:

For example:

At age 30,

100 − 30 = 70% in stocks and 30% in bonds.

At age 50,

100 − 50 = 50% in stocks and 50% in bonds.

At age 70,

100 − 70 = 30% in stocks and 70% in bonds.

This gradual shift reduces exposure to market volatility as you approach retirement, prioritizing capital preservation over aggressive growth. This reduces risk expose as you grow older.

Why Does the Rule of 100 Work?

The Rule of 100 is based on the principle that younger investors can afford to take more risks because they have time to recover from market downturns. As individuals age, their focus shifts from growing wealth to preserving it, making safer investments more suitable.

Key Benefits:

- Simplicity: The rule provides an easy-to-follow framework for asset allocation.

- Risk Reduction: It aligns investment strategies with decreasing risk tolerance over time.

- Flexibility: The rule can be adjusted for individual preferences or financial circumstances.

Example Portfolio Allocations

The table below provides a summary of the portfolio allocation for different ages. There are 3 examples, at age 30, age 50 and age 65.

| Age | Stocks (Risky Assets) | Bonds/Cash (Safe Assets) |

| 30 | 70% | 30% |

| 50 | 50% | 50% |

| 65 | 35% | 65% |

For a retiree at age 65 with $500,000 saved:

Stocks: 500,000 × 35% = $175,000

Bonds: 500,000 × 65% = $325,000

This allocation helps protect savings while still allowing for moderate growth.

Assumptions Behind the Rule

The Rule of 100 operates under several assumptions:

- Life Expectancy: It assumes a typical retirement duration of about 20–30 years.

- Risk Tolerance: Older individuals are presumed to have lower risk tolerance.

- Market Behavior: It relies on historical trends where stocks outperform bonds over time.

Limitations of the Rule

While helpful as a general guideline, the Rule of 100 has limitations:

- Longer Life Expectancies: With people living into their late 80s or beyond, retirees may need higher growth to ensure their savings last longer.

- Low Bond Yields: Current bond returns are historically low, potentially reducing portfolio performance.

- Individual Factors Ignored: The rule does not account for personal risk tolerance, financial goals, or other income sources like pensions or Social Security.

For instance:

- A risk-tolerant retiree might prefer a higher stock allocation even at an older age.

- A conservative investor may find the suggested stock allocation too aggressive.

credits to https://unsplash.com/@halacious

Modern Variations

To address these limitations, some experts propose variations:

- Rule of 110 or Rule of 120: Subtract your age from a higher starting number (e.g., 110 or 120) to allocate more to stocks and less to bonds. This results in a slightly higher exposure to risk compared to Rule of 100. In addition, this approach reflects longer life spans and the need for growth during retirement.

For example:

At age 40 under the Rule of 120:

120 − 40 = 80% in stocks and 20% in bonds.

When Should You Use the Rule?

The Rule of 100 is most effective as a starting point for asset allocation rather than a strict formula. Consider using it if:

- You want a simple framework for adjusting your portfolio as you age.

- You prefer a conservative approach to managing retirement savings.

- You’re unsure how to balance risk and reward over time.

However, always tailor your strategy based on your unique circumstances and consult a financial advisor for personalized advice.

Final Thoughts

The Rule of 100 offers a simple yet effective way to manage retirement investments by balancing growth and safety as you age. While it has its limitations, it serves as a useful starting point for creating a retirement plan that aligns with your financial goals and risk tolerance. By understanding its principles and adapting them to your needs, you can build a secure and sustainable retirement portfolio.

Do you think the Rule of 100 works for you?

Share your retirement strategies with us.

One thought on “The Rule of 100: A Simple Guide to Retirement”